change in net working capital cash flow

The 2004 change to the net capital rule responded to two issues. Annual cash flow by MarketWatch.

Studywalk Working Capital Wc Change In Wc Change In Working Capital Free Cash Flow To Equity Free Cash Flow To Firm Curr Finance Cost Accounting Equity

Abbreviated it looks like this.

. So a positive change in net working capital is cash outflow. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. Free Cash Flow to Firm FCFF commonly referred to as Unlevered Free Cash Flow.

Net Working Capital 2017 -12693 Cr. CAPEX Capital Expenditures Δ Net WC Net Change in Working capital. If there are mandatory repayments of debt then some analysts utilize levered free cash flow which is the same formula above but less interest and mandatory principal repayments.

First the European Union EU had adopted in 2002 a Financial Conglomerate Directive that would become effective on January 1 2005 after being enacted into law by member states in 2004. Levered free cash flow earned income before interest taxes depreciation and amortization - change in net working capital - capital expenditures - mandatory debt payments. This is because a decrease in working capital means you earned cash whereas an increase in working capital uses cash.

Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital. How to calculate levered free cash flow. Similarly change in net working capital helps us to understand the cash flow position of the company.

If there is too much cash the business may decide to repay loans so that interest payment in the future will be low or pay. Unlevered free cash flow ie cash flows before interest payments is defined as EBITDA - CAPEX - changes in net working capital - taxes. The Net working capital of Colgate Palmolive India had increased from -12693 Cr in 2017 to 7793 Cr in 2018.

Its important for your company to strive for a decrease in working capital. Similarly negative change in. For example if a company purchased equipment last.

Net Working Capital 2017 Total Current Assets Total Current Liabilities. Whereas if more money went out the result would be a negative cash flow. A change in working capital is the difference in the net working capital amount from one accounting period to the next.

A common explanation for a company with a net loss to report a positive cash flow is depreciation expenseDepreciation expense reduces a companys net income or increases its net loss but it does not involve a payment of cash in the current period. And Free Cash Flow to Equity FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow. The LFCF formula is as follows.

You have to think and link what happens to cash flow. These expenses include the repurchase of treasury stock repayments etc. The balance sheet organizes assets and liabilities in order of liquidity ie.

Read more will be. Working capital presentation on the cash flow statement. This is the generally accepted definition.

While converting assets into cash quickly is crucial managing the procure to pay cycle is also key to cash flow. In this years report we have continued to review five-year trends 2014 2018 and reflected on the advent of digital and its potential for. For example if a companys accounts receivable increase.

Working capitalalso called net working capitalreflects the amount of money a company has at its disposal to pay for immediate expenses. But levered free cash flow is more accurate. Any change in the balances of each line item of working capital from one period to another will affect a firms cash flows.

This derives a much more accurate representation of the Cash that a company generates than does pure Net Income. Youd calculate the NCF by looking at your cash flow statement particularly the three cash flow. Working capital is the cash tied up in the everyday running of a business Each year PwC UK review the financial performance of the largest global listed companies assessing their working capital performance and related key indicators.

The Net Cash Flow Net Cash Flow Net cash flow refers to the difference in cash inflows and outflows generated or lost over the period from all business activities combined. Of course the more working capital the better it for. Current vs long term making it very easy to identify and calculate working capital current assets less current liabilities.

The owners capital includes preference share capital and borrowings. This Directive required supplemental supervision for unregulated financial ie bank insurance or securities holding. This means that the liquidity position of the company is better off.

In a 2021 PWC report 65 of executives revealed that working capital management is the main objective of restructuring and change management activities. Article Sources Investopedia requires writers to. Net cash flow NCF is a metric that tells you whether more cash came in or went out of a business within a specific period of time.

Net Cash Flow from Financial is calculated by deducting financial expenses from financial Income. Change in working capital is a cash flow item that reflects the actual cash used to operate the business. If more cash came in the result would be a positive cash flow.

Meanwhile the cash flow statement organizes cash flows based on whether items are operating investing or financing. Cash flow refers to the net cash generated by the company during the specified period of time and it is calculated by subtracting the total value of the cash outflow from the total value of the cash inflow whereas net Income refers to earnings of the business which is earned during the period after considering all the expenses incurred by the company during that period. Unlevered vs Levered Free Cash Flow.

Cash flow from operations Net income non-cash items changes in working capital For example a company has in millions an operating income of 8500 depreciation of 0 and changes in working capital of -1200. How can a company with a net loss show a positive cash flow. Net working capital is defined as current assets minus current liabilitiesThus if net working capital at the end of.

View AMZN net cash flow operating cash flow operating expenses and cash dividends. Net Working Capital 2017 85562 98255. The change refers to how the cash flow has changed based on the working capital changes.

To explain this further I am going to quote from Jae Jun who has written several great articles on this very subject. CFS- In the end the Closing Balance of. Free Cash Flow FCF is calculated by taking the Operating Income EBIT for a business minus its Taxes plus Depreciation Amortization minus the Change in Operating Working Capital and minus the companys Capital Expenditures for the year.

Changes in working capital is the net change in inventory accounts receivable and accounts payable with the measurement period. So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. Managing cash flow if the cash flow forecast gives a negative cash flow for a months then the business will need to plan ahead and apply for an overdraft so that the negative balance is avoided as cash come in and the inflow exceeds the outflow.

Incomes include cash received against share issuance and borrowings done by the company. In simple terms it is the net impact of the organizations cash inflow and cash outflow for a particular period say monthly quarterly annually as may be required. FCFF vs FCFE FCFF vs FCFE There are two types of Free Cash Flow.

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Financial Statement Analysis Personal Financial Statement

Cash Flow From Operating Activities 2 3 Cash Flow Statement Cash Flow Cash

Cash Flow From Operating Activities Cash Flow Statement Cash Flow Positive Cash Flow

Example Cash Flow From Operating Activities Alphabet Inc Cash Flow Statement Business Valuation Financial Modeling

Cash Flow From Financing Activities 1 2 Cash Flow Statement Finance Debt Raising Capital

Cash Flow From Investing Activities 2 2 Cash Flow Statement Cash Flow Investing

Cash Flow Statement Format Cash Flow Statement Cash Flow Accounting Basics

Cash Flow Statement Payment And Equipment Accountingcoach Cash Flow Statement Cash Flow Education Sales

Free Cash Flow Cash Flow Cash Flow Statement Free Cash

Example Cash Flow From Operating Activities Alphabet Inc Cash Flow Statement Business Valuation Financial Modeling

Cash Flow From Operating Activities 3 3 Cash Flow Statement Cash Flow Cash

Cash Flow From Operating Activities Cfo Cash Flow Statement Cash Flow Direct Method

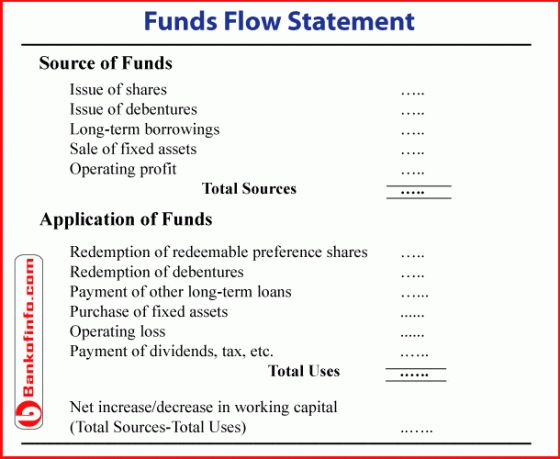

How To Prepare Fund Flow Statement Fund Cash Funds Flow

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working C Management Capital Finance What Is Work

Cash Flow From Financing Activities Cff Cash Flow Statement Cash Flow Finance

Example Cash Flow From Investing Activities Alphabet Inc Cash Flow Statement Cash Flow Investing

Free Cash Flow Cash Flow Cash Flow Statement Positive Cash Flow

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap It Network Management Capital Finance